The Indicator Store

presents...

one of the Best Systems for Ninjatrader :

MARKERS lite is the beginners version of Markers Plus

MARKERS is an Indicator, so it allows to be used with Chart Trader enabled.

MARKERS detects Objects painted by your Indicator on the Chart ;

We can specify one object to Trigger Long Entries and another Object to Trigger Short Entries. It is possible to specify Colors for the Triggers Objects, so we can use same object but with different Color to Trigger a Long or a Short :

MARKERS can also be configured to Close Positions ( if any ) when a User defined Object is Painted :

Example : Markers Detecting a Red Arrow to Enter Short and a Yellow Diamond to Close Position :

The Detected Objects can be Painted by any Indicator you own.

Markers Lite System can automate all your Indicator Signals, and auto trade all of them or you have the option to Enable Next Long & Next Short on a Semi Automatic Mode.

Markers Lite includes Money Management, so you can limit the Daily Loss & Daily Profit of your Setup

Markers Lite includes a User Defined Time Window; Only Signals detected inside this Time Range will execute Orders. Any remaining position will be Closed outside this Time Range.

In other words, with MARKERS LITE it is possible to full Automate any Indicator Signals.

If you need more complex Trade Definitions with the Option to add Complex Trend filters, take a look at Markers Plus.

Take a Look on our G+ Channel Collections for Examples using Markers with different Trade Setups :

- Supertrend + Markers Examples

- SRS + Reversal + Markers Examples

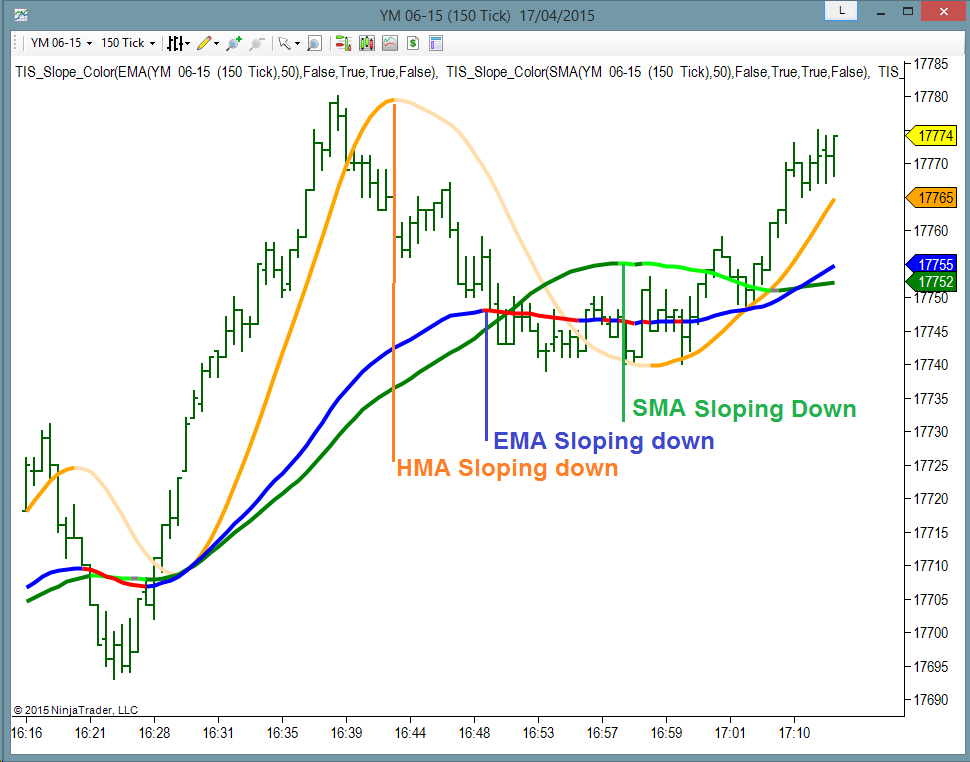

- EMA Examples

- ATR BarColor + Markers Examples

YouTube Videos Here :

- Auto Trading Signals with Markers Lite for Ninjatrader

- Testing Markers Lite with a Custom Indicator

- Understanding the Reversal Setup

- Understanding the Supertrend

- Understanding the ATR_BarColor ( ATRBC ) Setup

- Using Ninjatrader Market Replay on EMA Setup

Best Regards,

Pablo Maglio

|

Skype id : pmaglio Skype id : pmaglio |