SRS Setup Short on Russel, September Futures Contract ( TF 09-13 )

Risk = 15 Ticks ( $150 )

Minimum Target = 30 Ticks ( $300 )

SRS Setup on Gold, December Futures Contract ( GC 12-13 )

First short was in the Premarket at Europe Trading Time

Last 2 Longs had a Risk of 15 Ticks ( $150 ) and a Minimum Target of 20 Ticks ( $200 )

Don't forget to check more info about the Indicators and Strategies at :

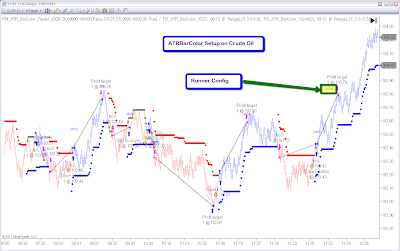

SRS Indicator - SRS Strategy - SRS Semiautomatic Strategy

ATR_BC Indicator - ATR_BC Strategy - ATR_BC Semiautomatic Strategy

Ichimoku Indicator

Volume Profile Indicator

Please subscribe or update your preferences on this link

Regards,

Pablo

| Pablo Maglio , The Indicator Store |