SRS Setup Review

Hello Traders !

Today we are revisiting the SRS, explaining its rules and different Trade Setups that we can trade with it.

- Classic Use with the Trend

- Classic Use against the Trend

- Alternate use on SRSx Setup

Lets start for the Begining : Trend Definition

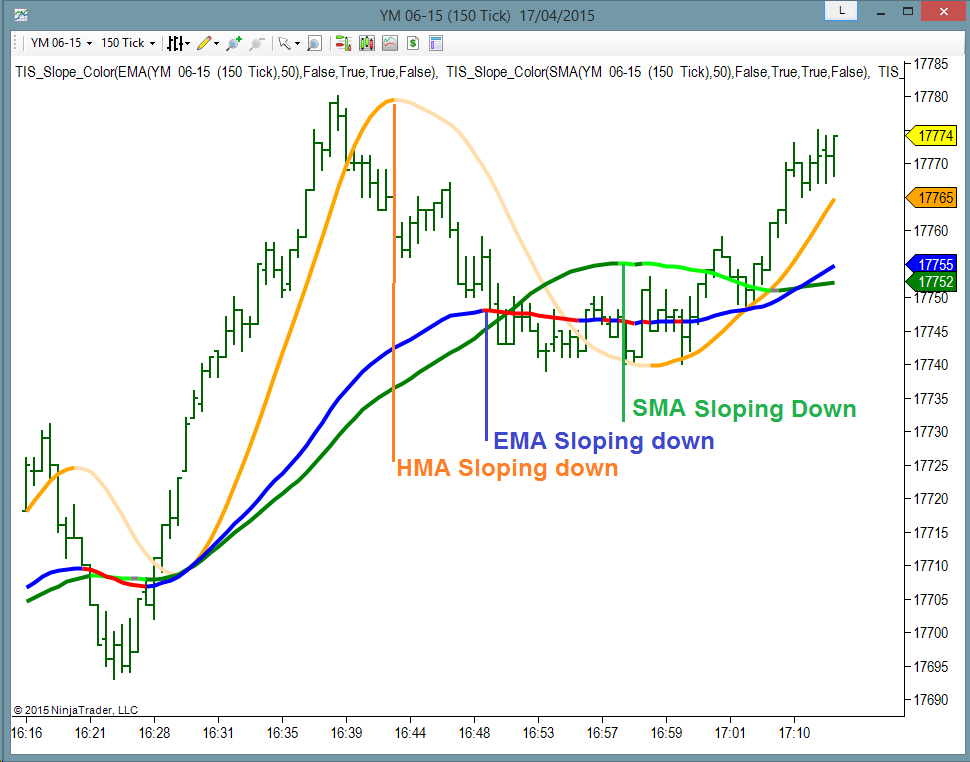

On SRS we use an exponential envelope (DarkGolden lines) and an exponential moving average (Blue Line) to define the trend.

The Blue Line has a slower ( higher ) period than the Envelope, usually a number in the order of 50, 100 or 200.

The Envelope uses a faster ( lower ) period to follow the price.

Its size is fixed, and it should be big enough to keep the Blue Line inside while the Market is in sideways mode or changing the trend.

We can control the size of the sideways zone by changing the size of the envelope.

The trend has 3 possible states :

- Trending Down ( Envelope is all below the Blue Line )

- Trending Up ( Envelope is all above the Blue Line )

- No Trend = Sideways ( Blue Line is inside the Envelope )

Once the trend is defined, then we use a Donchian Channel to define the Trade Ready Condition :

When the Bars are touching the Upper Donchian and the Trend is Down, then we have a Short Trade Ready Condition.

Those bars are shown on the following picture with Orange Diamonds.

The Trade Setup Entry is at N ( default = 3 ) ticks below the low of the Signal Bar, just where the Diamonds are located.

That means that for Manual Trading this setup we place a Sell Stop Order over the Diamond and keep adjusting the Entry Price as each new Diamond is painted.

On the example shown above, we have an entry on the 3rd and final diamond ; the order placed there gets a fill at the next bar.

On the last version of the TIS_SRS Indicator we have the option to hide or show the lines ( EMA, Envelope and Channel ), the Diamonds, to paint the Bars according to the Trend and also the option to place a Marker where there is an entry, to make this indicator compatible with the Markers System.

Trade Setup against the Trend

On the classic ( with the trend ) setup the blue line is slower than the envelope ( blue line period > envelope period ).

On the counter trend Setup we exchange its values, so the blue line is now faster than the envelope

Following the same rules with the Donchian and using the same Entry Technique than before we can see that we get long signals at the bottom extremes and sell signals at the tops.

Again, we can trade this Setup Manually by placing Entry Stop Orders over the Diamonds.

Or Enter the Market when we get an Arrow. This can be automated with the Markers System.

SRSx ( Extreme ) Setup

This Setup uses the same method to define the trend bu the Entry Technique is different.

On this Setup we trade a Breakout. And the breakout is detected when the Blue line gets outside of the Envelope.

As we can see on the above picture, the Blue line is faster than the Envelope.

When the Blue line is above the Envelope, then the Trend is Up and we get Blue Bars.

If Market is making new highs ( detected through the Bars touching the Donchian ) then we have a Diamond.

The Entry is at Market ; as soon as we get a Blue Diamond we Enter Long. Usually the first signals per side are the best, so we should only enter one or 2 times per side.

To automate this Setup we can use the Markers System by targeting the Diamonds as Entry Signals. The price location of the Diamonds has no use on this Setup.

The period of the blue line here should be very fast. And the size of the Envelope, should be tuned to avoid the system to trigger signals when not impulsing or trending. ( see left and right part of the Chart )

Parameters of TIS_SRS for SRSx Setup ;

To be able to follow the SRSx Setup with the TIS_SRS Indicator we need to do some tweaks on the parameters as shown :

As we can see, the colors are inverted, the period of the blue line is really fast with a period of 2. The offset to place the Diamonds is negative so we get them on the other side of the Bar. On this example, using a Range 6 Chart (where all bars are 6 ticks tall) placing the Diamond at -9 is like placing it at 3 ticks from the opposite extreme.

Related Videos :

I will post here links to related videos using the last version of the SRS Indicator and the Markers System to show how to configure and use them to trade the different Setups.

Live Examples using the 3 different trade setups and automating the Entries with Markers

Pablo Maglio

www.TheIndicatorStore.com

Skype id : pmaglio

Skype id : pmaglio