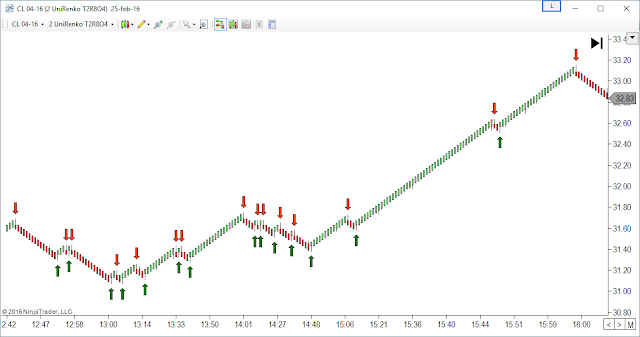

As we saw on previous post, Markers can detect objects painted on the Chart, like Arrows, Dots, Vertical Lines, etc ; most of the standard Ninja Objects used by Indicators to paint Entry or Exit Signals.

And when detected, Markers can issue ATM Orders.

An ATM Order includes not only the trade size, but also the number of positions ( 3 on Ninja 7 and unlimited on Ninja 8 ) and the corresponding Stop, Target, Trailing and Auto Breakeven for each position. Read More.

Now, let's compare the 2 versions of Markers ;

| Features | Markers Lite | Markers Plus |

| Number of Objects Supported | 9 | 19 |

| Option to Close Positions | Yes | Yes |

| Manual & Semi Auto | Yes | Yes |

| Max Daily Loss/Profit | Yes | Yes |

| Time Windows | 1 | 3 |

| Entry Order Type | Market | Market / Limit / Stop |

| Option to Filter Signals | No | Yes |

| Tool to Create Signals | No | Yes |

Both Markers Versions can be purchased on this link

The Main Differences are these :

- Markers Lite can automate signals painted by another indicator

How can I check that my indicator signals are standard Ninja Objects and can be detected ? Read the end of this post to learn about. - Markers Plus include several Tools, with which we can create our own Signals and also our own Filters.

This allows the option to create an unlimited number of trade setups and save them as templates.

Markers Plus includes a shared library of templates constantly improving and growing.

How can we know if the signals painted by our indicator are standard and can be detected by Markers ? . . . . Just doing double click over the object ;

If we get the Object Properties Dialog, then it is a Standard Ninja Object and can be detected by Markers.

Example :

If after doing the double click we dont get response or we get the indicator properties window, then this object is not compatible with Markers.

On the following Post, we will cover the features of Markers Plus