There are different ways to Trade a Market, no matter what Instrument or Time Frame, we must analyze which works best ;

I would classify the possible Setups in 2 Ways ;

- Trade Breakouts

We must define a rule to specify an area ( over and below the market ) that once broken will trigger an entry signal ; a long when the area is broken to the upside, and a short when broken to the downside. - Trade Pullbacks

We must define a rule to calculate the Trend.

When it exceeds a threshold, then we are trade ready to enter on a retracement

Some instruments can be traded better on one mode than the other.

The combination of instrument and timeframe is also important, because the same instrument can perform better with breakouts on one time frame while working better with pullbacks on other.

Examples :

This is a 5 Minutes EURUSD Forex Chart

If we use the last 8 Bars Pivot ( we can use the Swing(8) Indicator) then we can define our breakout area by the last detected upside pivot and last detected downside pivot.

The Breakout Entry method could then be placing bracket Orders at those levels ;

- Buy Stop at Green Line Level

- Sell Stop at Orange Line Level

As we can see, when the market is very volatile the results are excellent.

But when it moves sideways, like at the end of the session, we start having some fake breakouts, like at the end of the day, between the 2 blue arrows, there was a failed breakout to the downside ( orange line just moved a few ticks lower )

On the next picture we have the same Chart with an example of a Pullback Entry ;

We use 2 lines ; a fast (bue) and a slow (black) moving average.

When the blue crosses below the black we start looking for a short at a retrace to the black line.

We can trade only first, second, or N retracements.

Until the blue line crosses above the black, and then we start looking for a long at a retrace to the black.

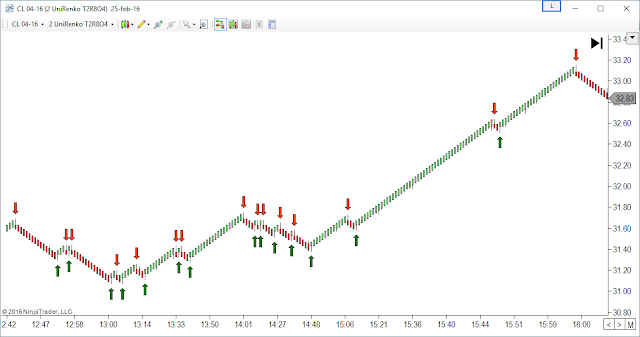

Here we have an example on Crude Oil ; only 2 trades with a pullback entry ;

Using the breakout entry doesn't looks good on this Chart ;

( each time we see a lower orange line there is an entry, but the available profit is too small)

But if we change the time frame for the same day, now the setup looks much better ;

With these concepts, we can identify on our preferred Instrument and Chart Combination

which is the best Setup Mode to Use.

On the following posts I will cover different ways to configure both Setup Modes ; Breakout and Pullback

Please post any question or comment below this post.

|

Skype id : pmaglio Skype id : pmaglio |