🔄 Unlocking Signal Automation in NinjaTrader 8 with Coral Trend & ADX_VMA

Automation is no longer optional for traders aiming to stay competitive — it’s essential. With the latest updates to TIS_Coral_Trend and TIS_ADX_VMA, The Indicator Store is empowering traders to transform visual insights into actionable, automated strategies in NinjaTrader 8 — without a single line of code.

In this post, we explore how these upgraded indicators work, how to fine-tune their signal sensitivity, and — most importantly — how to copy their signals directly into Markers for seamless strategy automation.

🎯 Coral Trend: Visual Slope Detection with Precision Control

The TIS_Coral_Trend indicator uses a slope-based algorithm to identify trend direction changes in real-time. But the key innovation lies in its signal generation and automation compatibility.

Key Parameters:

-

Period: Controls how reactive the line is to price changes. Lower values = faster reactions.

-

Constant D: A sensitivity multiplier. Higher values = more signals, including intra-trend fluctuations.

Together, these parameters allow you to calibrate the indicator from ultra-conservative to hyper-sensitive — ideal whether you're swing trading or scalping.

The signal plots (Signal Up, Signal Down) are now fully exposed as plots, which means you can instantly copy them into Markers or the Strategy Builder.

⚡ ADX_VMA: Momentum Meets Volatility

The upgraded TIS_ADX_VMA combines ADX-driven volatility with dynamic signal output for:

-

Long Entries when trend strength rises

-

Short Entries when trend reverses

-

Exit Signals when momentum fades

Customizable Parameters:

-

ADX Period: Defines the historical window for trend strength.

-

ATR Sensitivity: Sets the threshold for filtering out weak signals.

Want fewer, more meaningful signals? Increase sensitivity. Want rapid feedback? Lower it. The flexibility here gives you surgical control over your entries and exits.

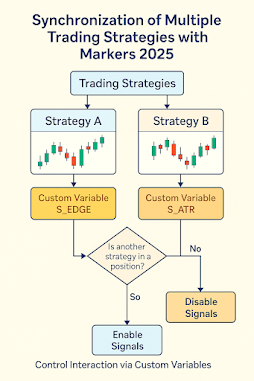

🧠 From Plots to Power: Automating with Markers 2025

The real game-changer is the ability to copy plotted signals directly into Markers 2025 — turning any visual signal into a functional rule within your trading strategy.

Here’s what you can do:

-

Copy plots from Coral Trend or ADX_VMA into Markers

-

Assign them as fast signals for immediate execution

-

Build logic conditions using Markers' intuitive interface

-

Define time filters, order types, ATM strategies, and risk limits

This setup makes your strategies not only reactive but fully modular. You can build a setup once and reuse or adapt it endlessly.

💡 Why It Matters

Manual trading is reactive. Semi-automated trading is scalable. But fully automated trading is where consistency, discipline, and edge truly converge.

By combining Coral Trend or ADX_VMA with Markers 2025, you unlock:

-

✅ Visual logic without coding

-

✅ Modular system design

-

✅ Multi-account trade replication

-

✅ Compatibility with any plotted signal

#TheIndicatorStore #NinjaTrader #Automation #TradingTools