Filtering our signals taking into account the trend defined on a Higher Time Frame is one of the most important factors to take into account.

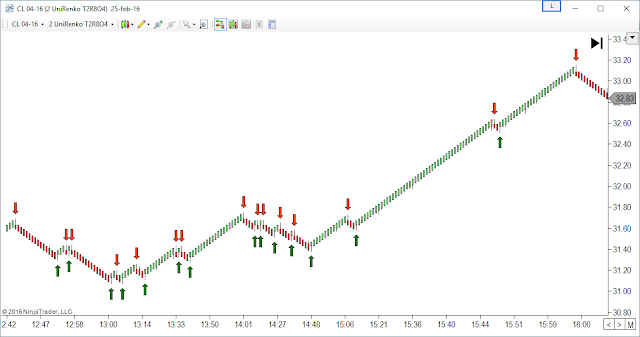

We can see on these Charts some Examples :

This is a High Time Frame Crude Oil Chart, very slow for Day Trading, where each bar has a Size of 18 Ticks, too big for the precision of an average day trading trade, where we use targets and stop near or lower those 18 Ticks.

But if we go back to our Trading Chart, much faster than this one, where we can have several Up and Down signals during one single bar of this slow Chart, which of these trades will have more Odds to Succeed ?

It is evident that we can get much better targets and less losers if we filter these signals using the higher timeframe trend.

Now, How we define the Trend ?

1) OpenClose

The example shown here ( 1st Chart ) is the easiest way ; while bars are closing up (green), the Trend is Up. When bars are closing down (red), the Trend is Down.

This is the faster and easier way to define the trend, and using some kind of fine tuning with Renko Bar we can avoid having noise or fast trend changes on sideways

- We can see an example on Gold on this post

There are lot of other ways to define a trend ;

2) Moving Average Slope ( We can use SMA, EMA, HMA, etc )

Looking at the slope of a moving average is the 2nd fastest way to define a trend, and we can add a threshold to filter out noise.

On this example I'm using an EMA(34) and we can see that we get the same trend signals than on the OpenClose

Using the Markers Tool Slope we can measure this Trend and have it available on any other Chart, no matter what time frame or instrument.

Now, on our working chart we can specify a Markers filter for long and shorts this way ;

Markers will automate any detected signal only if the corresponding side filter is in agreement.

3) Relative Position of 2 Lines ( We can use SMA, EMA, HMA, etc )

We use 2 lines ; a fast moving average and a slow moving average.

When fast is above the slow the trend is up, when it is below, the trend is down.

The faster the periods and the closer the fast and slow periods, the fast the signal we get.

On this example, we have an EMA(36) [blue] and an EMA(34) [red]

We can see that the signals ( Arrows ) have some delay and filtering in relation to the OpenClose trend direction

To apply this method using Markers Tools, we need to copy both lines and then use the XO Indicator to calculate the distance between them ;

In total we use 3 indicators ; 2 Copy instances and one XO.

The variable defined on XO ; ema34vs36 is available on all charts and can be used to filter our signals as on previous method.

We can filter longs when ema34vs36 is greater than zero or a positive threshold.

...and shorts when it is smaller than zero or a negative threshold.

Having defined the Trend ( on current or higher time frame chart ) now we can focus on the signals of the work chart, usually the fastest time frame.

We will see some examples on the following posts.

Best Regards,

Pablo Maglio

|

Skype id : pmaglio Skype id : pmaglio |