📈 TIS_Slope_Color: Visualize Trend Shifts Instantly with Color-Coded Precision

When it comes to technical analysis, simplicity and clarity often outperform complexity. That’s exactly the philosophy behind TIS_Slope_Color, a tool designed to help traders visualize trend direction instantly—without interpreting dozens of indicators.

🔍 What Is TIS_Slope_Color?

TIS_Slope_Color is a clean, lightweight indicator that paints the line of your moving average based on its slope. Rather than relying on lagging crossovers or multiple trend filters, this tool gives you immediate visual feedback about momentum and direction.

It works with any moving average type (EMA, SMA, HMA, WMA, etc.) and adapts seamlessly to your strategy.

🎨 How It Works

-

🟢 Positive slope → Line turns green → Uptrend or rising momentum

-

🔴 Negative slope → Line turns red → Downtrend or weakening market

-

🟠 (Optional) Neutral slope or flattening → Colored differently (e.g., yellow/orange)

This color-coding lets you scan the chart quickly and spot shifts in direction without delay.

🧠 Why Use It?

Most moving averages only offer value when crossovers happen—but by then, you may be late.

TIS_Slope_Color offers:

✅ Early detection of slope changes

✅ Visual confirmation of trend continuation or reversal

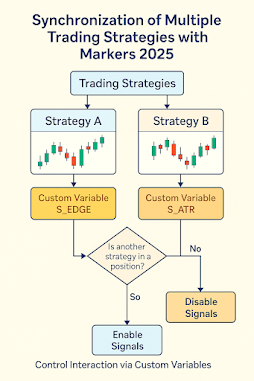

✅ Support for automation using Markers, Strategy Builder, or NinjaScript

✅ Less chart noise compared to multi-indicator templates

Whether you’re a discretionary trader or building rule-based systems, TIS_Slope_Color provides one of the clearest visual tools for identifying momentum shifts.

⚙️ Use Cases

Here are just a few ways traders apply TIS_Slope_Color:

-

✅ Confirming entry direction in a trend-following strategy

-

✅ Filtering signals from oscillators or price action

-

✅ Dynamically adjusting trailing stops based on slope color

-

✅ Highlighting trend shifts in multi-timeframe dashboards

It’s ideal for scalpers, swing traders, and algorithmic strategies alike.

💡 Example Strategy

-

Set your preferred moving average (e.g. 21-period EMA)

-

Use TIS_Slope_Color to detect slope direction

-

Only take long trades when the line is green

-

Automate this filter in Markers 2025 or Strategy Builder

-

Combine with your favorite entry trigger (like breakout, candle pattern, etc.)

This simple rule can significantly reduce false entries and keep you aligned with the prevailing move.