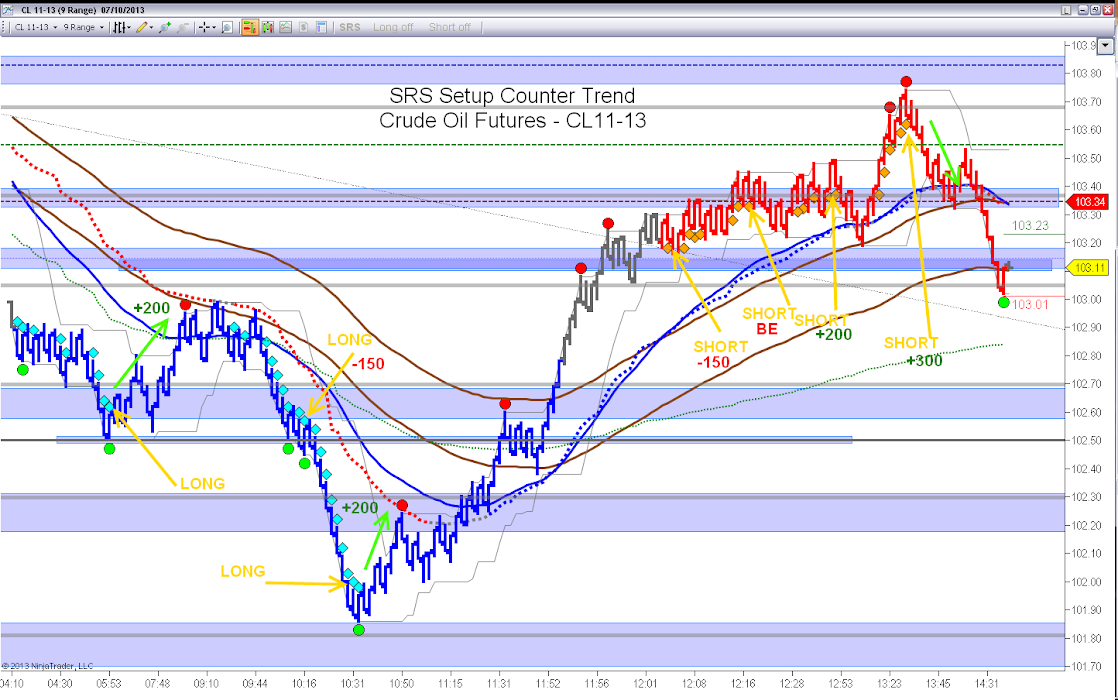

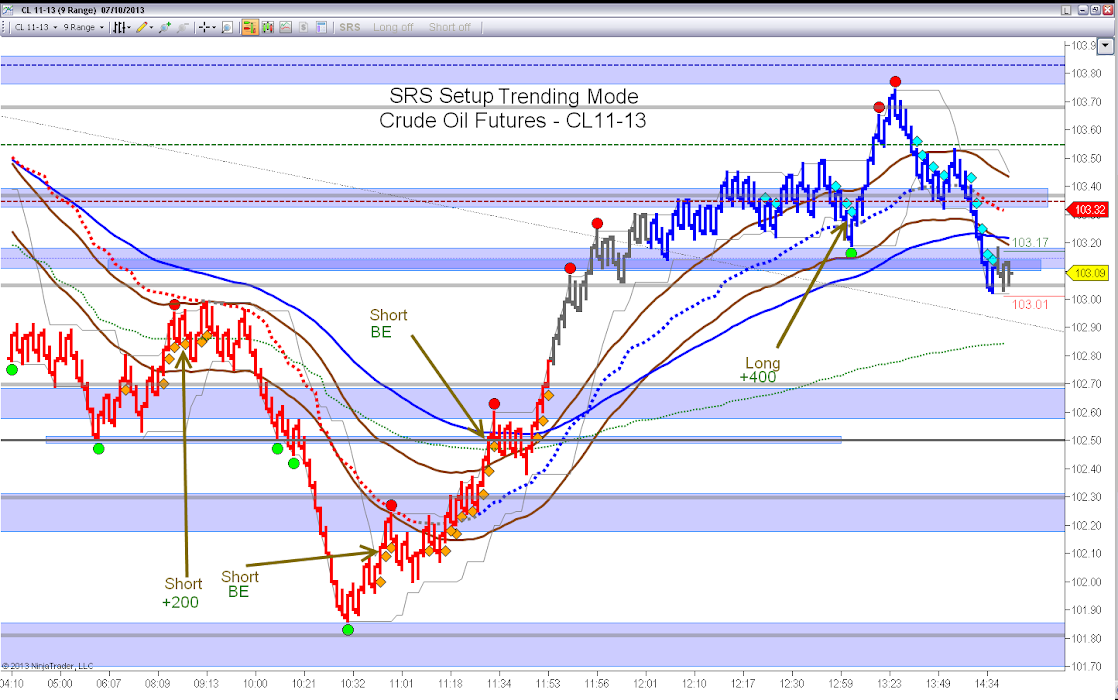

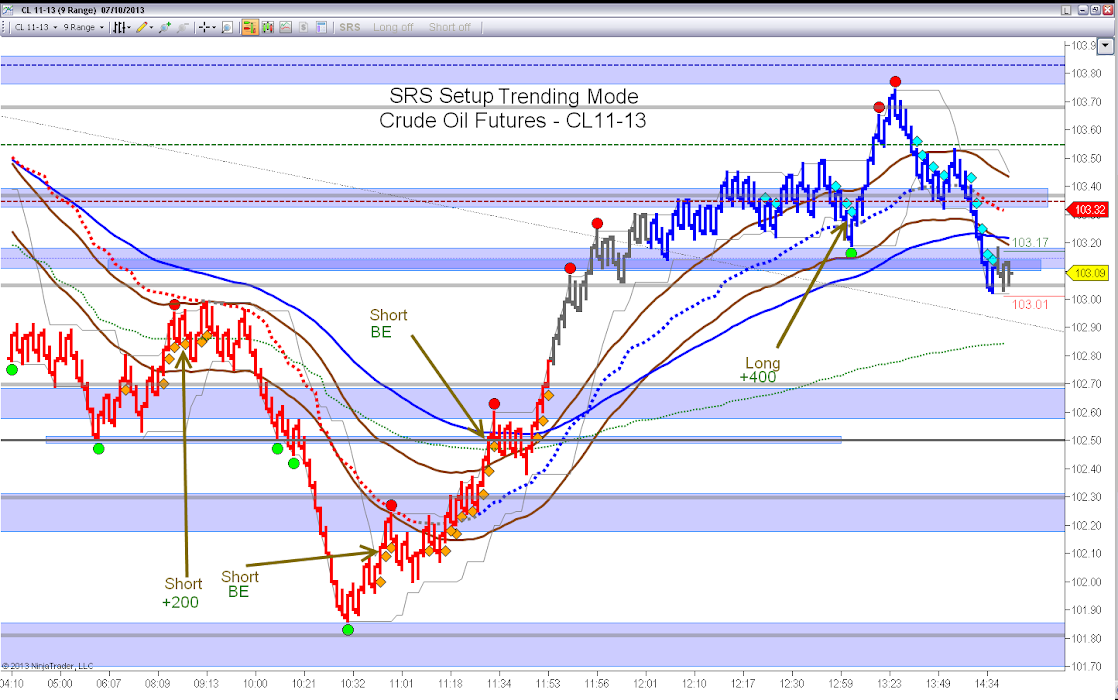

The most profitable markets are those with Impulsive Movements.

A Market leaves the Trend mode and switches to Impulse Mode when there are no more pullbacks big enough to get into the trade, and when it finally happens the move is finished leaving just a small winner or even a loser.

On volatile markets, the switch from sideways to Impulse is so fast that we dont even get an entry on the first trending pullback. This is why it is so important to define when the Impulse Mode is starting so we can use an early entry.

The most volatile markets are crude oil, gold, silver, nat gas ( CL, GC, SI, NG ).

Cash Index Markets like S&P ( ES ) are mostly on sideways or trending mode. Some of these trend moves may sometimes change to Impulse Mode, allowing to the trend entries increase their profits.

We have several ways combining classic Indicators, to define when the market is Impulsing.

The most used ways to trigger an Impulse Signal are :

1) A Fast Moving Average crossing outside a Slow Band

2) A Fast Band crossing all outside a Slow Band ( similar to previous method but with an extra security margin)

In the following Charts we can see both Methods ; ( The vertical Red Line shows where the Impulse Mode Starts on each example )

The Band can be a Bollinger Band, a Keltner Channel or a Fixed Envelope ( like on the examples shown )

We have to take into account that if we use Range Charts, all Bars will have same height, so volatility ( and ATR ) will be constant, turning Keltner Channels into Fixed Envelopes.

Now we have different ways to define the Impulse Mode Signals, now we just need to define the entry.

In a trend system, we use the slow EMA ( like on the

PM_EMA setup ), but on Impulsive Moves, the Markets never come back to the EMA.

The entry can be defined again using an envelope ( Bollinger, Keltner, Fixed ) of lower size than the signal envelope ;

An entry for example 1 can be the lower slow band ( green)

An entry for example 2 can be a 50% of upper fast band ( blue )

As shown, using EMAs and Envelopes to define signals and entries, we can get a big number of different setups. We just need to find the best combination for each Instrument.

Having all these rules automated is a big Help that let us backtest, optimize and even trade any configuration. We at The Indicator Store have a Strategy Pack called PM_Impulse, that contains several individual strategies following different combinations of the explained setups.

If you like this article please leave your comments and share with your firneds

Regards,