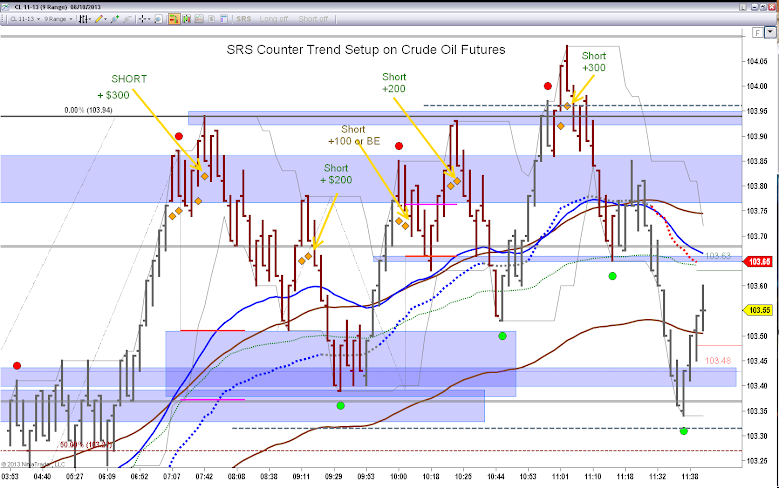

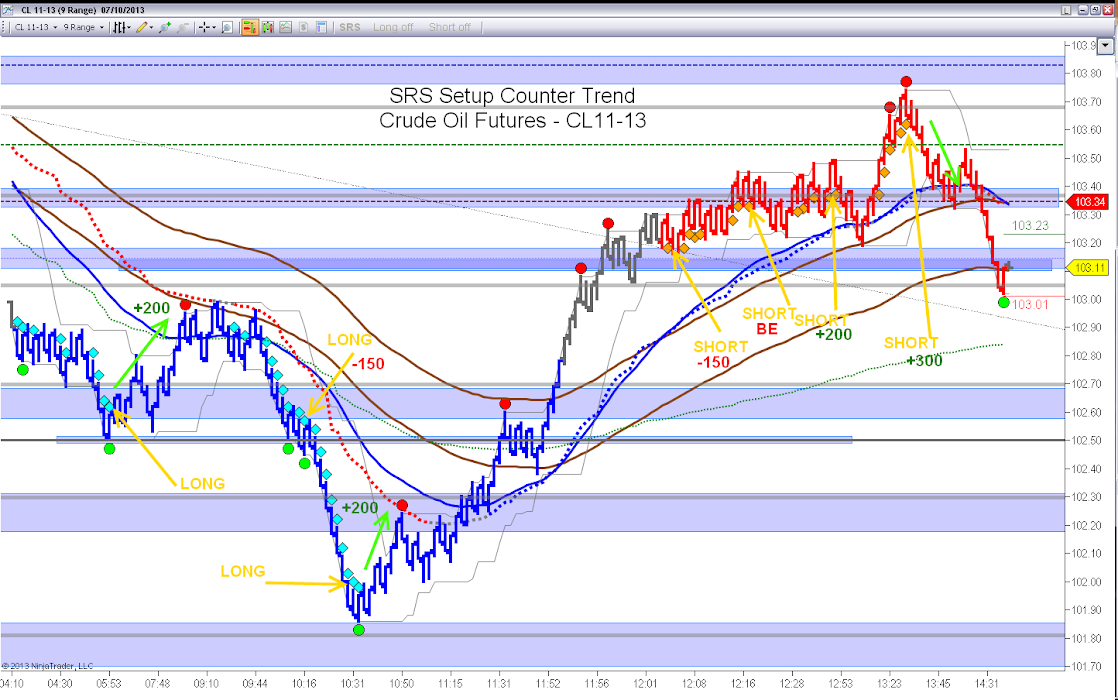

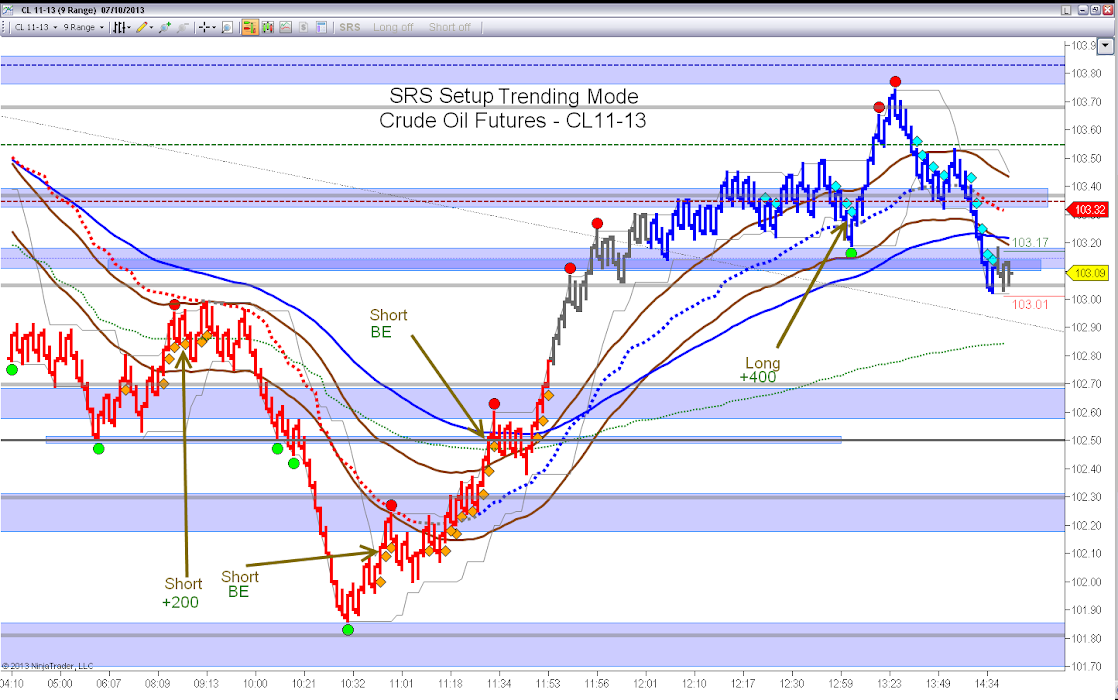

As you may remember, some time ago we talked about the different ways to detect reversals, using divergences, stochastics, etc...

Take a look at that entry on this link : "Selling Tops..."

We also applied an Entry Technique ; RBO using Stop Orders to Enter The Market when we have a Confirmed Reversal Signal.

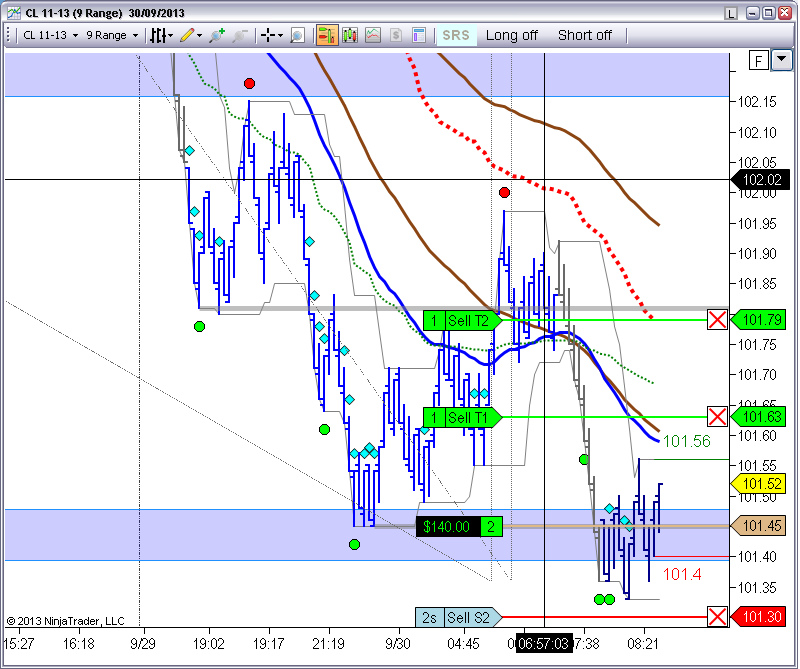

This is an example of an Entry Order after a Confirmed Over Bought Signal :

The settings I am using for the ATM ( using 2 contracts ) are these :

The System uses ATM Orders, so we can define several setting on the ATM definitions ;

3 positions, individual sizes, targets, stops, auto trails, auto break evens, etc.

On this video we can see how this setup worked today :

There are more different configurations and instruments on these other video Links :

Video #2 : http://www.youtube.com/watch?v=EjOR9VGzVx4

Video #3 : http://www.youtube.com/watch?v=suLMInvX13I

Best Regards,

Pablo