Crude Oil Futures, November Contract CL 11-13

9 Range Chart - SRS Setup

Long over Global Support and possible Double Bottom with Friday's Low at 101.45

Risk = 15 Ticks ( $150 )

Target 1 below last low pivot ( from the left ) at 101.63 ( + $180 )

Target 2 below main low pivot at 101.79 ( + $340 )

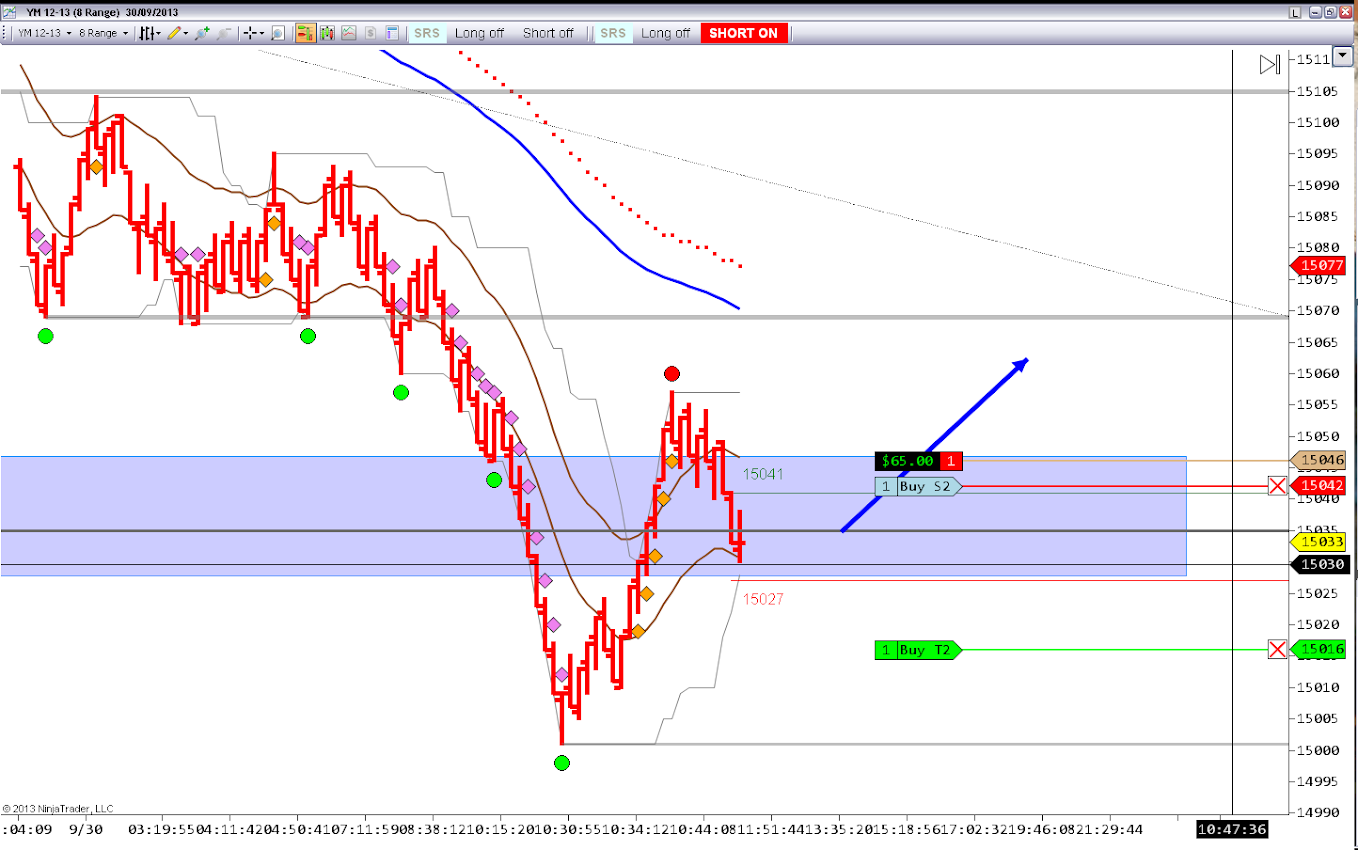

Dow Jones, December Contract YM 12-13

SRS Trending Setup on 8 Range Chart

SRS with the Trend overlapping Global Resistance

Short Entry = 15046

Risk = 14 ticks ( $87.5 )

Target 1 = 15 ticks ( $93.75 )

Target 2 = 30 ticks ( $187.5 )

Gold Futures, December Contract GC 12-13

SRS Countertrend Setup on Range 9 Chart

First Short signal of the day overlapping a possible double top

Risk = 15 ticks ( $150 )

Target 1 = 26 ticks at previous low overlapping global resistance ( $260 )

No comments:

Post a Comment