Crude Oil September Futures Contract ( CL 09-13 )

SRS Setup ; All day in sideways mode, only 1 short winner at noon :

Ichimoku Setup ;

3 trades ; 1st was a short but cloud was not acting as support for the trade, so there were reasons to avoid it

2nd was a long winner with cloud retest ( one of the best setups )

3rd and last was a long winner, but after lunch time, outside my trading time

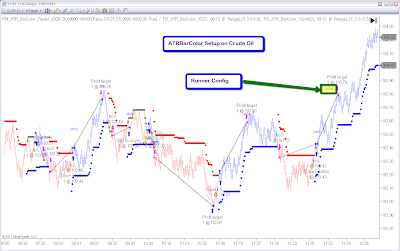

ATR BarColor Setups

Configuration 1 ( Classic ) : lot of trades, bad performance at the start during the sideways interval at the early morning, but finally finished on the positive side after the breakout

Configuration 2 ( Runners ) : Even worst performance during the sideways condition ( as it was expected ), but then recovered much better on the breakout finishing +700

Dow Jones September Contract - YM 09-13

SRS Setup with the trend ; 1 Long Loser

SRS Countertrend Setup : 2 Short Winners + 1 Short Loser

PM_EMA Setup : 2 Trades ; 1 Long winner + 1 Short Winner

Gold - December Contract ( GC 12-13 )

SRS Setup - Lot of trades, very volatile day, specially near the reports times at 8:15 & 8:30 AM ET ( 9:15 and 9:30 on the Chart )

Don't forget to check more info about the Indicators and Strategies at :

SRS Indicator - SRS Strategy - SRS Semiautomatic Strategy

ATR_BC Indicator - ATR_BC Strategy - ATR_BC Semiautomatic Strategy

Ichimoku Indicator

Volume Profile Indicator

Please subscribe or update your preferences on this link

Regards,

Pablo

| Pablo Maglio , The Indicator Store |